6 Critical Factors Bank Look At During Your Mortgage Loan Application

Securing a mortgage loan is a big deal when it comes to buying your own property in Singapore. It’s a crucial step that can impact your finances for the next 20 years.

But here’s the thing – many people don’t realize how important it is until it’s too late, and they end up losing their deposit. So, let’s take a closer look at what criteria banks consider when assessing mortgage loan applications.

Table Of Content

(In case you have just 5 minutes)

6 Critical Criterias Bank Look During Your Mortgage Loan Application

- Purpose Of Purchase

- Property Type

- Existing Number Of Properties You Own

- Financial Health & Credit Score

- Borrower's Age & Tenure Of Loan

- Total number of borrowers

1. Purpose Of Purchase

First off, banks want to know the purpose of your property purchase. Are you planning to live in it or use it as an investment? This information helps you evaluate your eligibility.

More often than not, more competitive mortgages packages are usually offer to those who are making a purchase for own stay vs for capital investments.

Source: Giphy

2. Property Type

You need to have a clear understanding of the housing market you are interested in.

Banks have different levels of risk tolerance for different property types like HDB flats, private condominiums, landed properties or commercial and provide different loan options for private housing and public housing, commonly known as Housing Development Board (HDB) flats.

If you are considering buying an HDB flat, you might want to explore the HDB Concessionary Loan. This loan offers a Loan-to-Value (LTV) ratio of up to 80% and currently has an interest rate of 2.6%.

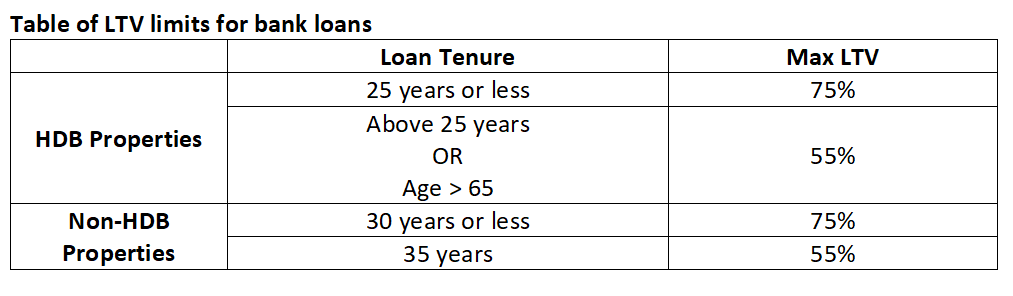

For bank loan for private property, the maximum LTV is up to 75% for the first loan, assuming if you don't have an outstanding home loan.

On the other hand, banks usually offer loans with interest rates that are tied to variable indexes like Singapore Interbank Offered Rates (SIBOR) or Singapore Overnight Rate Average (SORA). These indexes tend to be more unpredictable compared to the fixed interest rate offered by HDB.

3. Number of Property You Currently Own

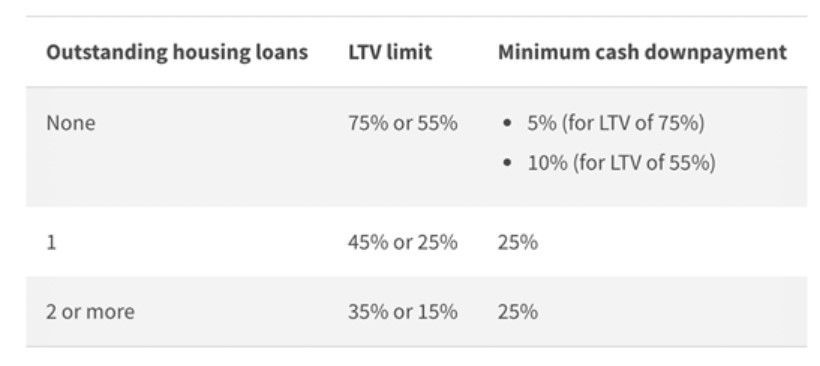

If you're purchasing your first property, you may qualify for a higher Loan to Value ratio (LTV).

This means that you can borrow a larger amount of money to finance the purchase. Several factors affect the LTV, such as your age, the number of properties you already own, and the type of property you are buying.

On the other hand, if you already own one or more properties, the LTV offered to you will be lower.

This implies that you would need to contribute more cash and/or CPF funds to cover the remaining amount. Essentially, banks might be less willing to lend you a larger sum due to your increased financial commitments and ability to handle multiple properties simultaneously.

4. Borrower's Age & Duration Of Loan

Banks also take into account the borrower’s age when the loan matures.

If you’re going to be 65 or older by the end of the loan term, banks might offer a lower loan-to-value ratio (LTV) because there are more risks involved.

They consider factors such as the possibility of retirement and a higher chance of defaulting. Just keep in mind that with a lower mortgage offer, you may need to make a higher down payment.

5. Financial Health & Credit Score

Your financial health plays a significant role as well. Banks will closely examine factors like income stability, debt obligations, credit history, and any savings or investments you have.

Stability in employment is important to banks as it demonstrates your ability to repay the loan over time. They may consider factors such as length of employment with current employer or any recent job changes.

A good credit score also indicates responsible repayment behavior and increases your chances of getting approved for a mortgage loan.

Showing that you have good financial discipline and stability can go a long way in getting approved for a loan.

6. Number Of Borrowers

When you’re applying for a home mortgage, the calculations can vary depending on whether you’re the only borrower or if there are multiple borrowers involved. If it’s just you, the bank will typically consider your age and income to determine your eligibility.

However, if there are multiple borrowers, the bank might use something called Income Weighted Average Age (IWAA) to assess the situation. Basically, IWAA takes into account the age of each borrower multiplied by their income and then calculates an average. This means that if one of the borrowers is younger but earns more money, the IWAA would be lower compared to if they earned less.

Why does this matter?

Well, a lower IWAA translates to a higher Loan-to-Value ratio (LTV), which means you’ll need to put down a smaller down payment. So, if you’re considering buying a property and have the option of choosing a co-borrower, having your child as a co-borrower instead of your spouse or sibling could potentially work in your favor.

To wrap things up, knowing these six criteria that banks consider when reviewing mortgage loan applications is crucial. By understanding them and meeting the requirements, you’ll be better prepared to secure the financing you need for your dream home. Remember to seek personalized guidance from your bank or financial advisor for advice tailored to your specific situation.

CEA: R022186H

Caron Choo

Wife . Mum . Property Consultant

I believe every family deserves to feel confident when buying, selling or renting their home.

PHONE +65 9832 9120

FREE PDF CHECKLIST

FREE Home Buying Checklist

FREE PDF CHECKLIST

FREE Home Selling Checklist

CATEGORIES

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. {{{NAME}}} and TREC, Inc. do not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. {{{NAME}}} and TREC Inc. will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.